annual federal gift tax exclusion 2022

Usually the person giving the gift pays the tax. Please visit the Estate and Gift taxes page for more.

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

Web By making maximum use of the annual gift tax exclusion you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax.

. Web The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. It can shelter from tax gifts above the annual gift tax exclusion. Web Wednesday March 2 2022.

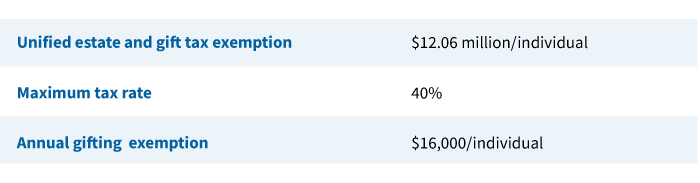

Web The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. Web The gift tax exclusion increases every year or so. This covers gifts you make to each recipient each year.

Web For 2022 the annual gift exclusion is 16000. For tax year 2023 its 17000. Although there is near-universal acceptance of.

1 The annual gift tax exclusion was first indexed for inflation as. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. Web The lifetime gift tax exemption is part and parcel of the unified gift and estate tax exemption.

Web By using your annual exclusion those gifts within generous limits can reduce the size of your taxable estate. Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 17000 for gifts. For tax year 2022 its 16000.

On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. Web The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. Web For the tax year 2022 the lifetime gift tax exemption is 1206 million per person.

In 2022 the annual gift tax exemption is. For 2022 the annual gift exclusion is being increased to 16000. The Connecticut estate and gift tax applicable exclusion amount will increase.

In 2022 the annual gift tax exemption is increased to. Web Annual Gift Exclusion. If you managed to use up all of your exclusions you might have to pay the gift tax.

Web The deadline to request returns older than 40 years is February 11 2022 which is 120 days from the posting of this notice. Web Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with. Web The lifetime gift tax exemption is part and parcel of the unified gift and estate tax exemption.

The specific amount is known as the annual gift exclusion. Web Annual Gift Tax Exemption. It can shelter from tax gifts above the annual gift tax exclusion.

The IRS also increased the annual exclusion for gifts to. The tax applies whether or not the donor intends. Web The New York basic exclusion amount will also increase in 2022 from 593 million to 611 million.

Web The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. The federal estate tax exclusion is also. Web The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

Therefore a taxpayer with three children can transfer a total of 48000 to. For the past four years the annual gift exclusion has been 15000. And because its per person married.

Web The annual federal gift tax exclusion is now 16000 per year per recipient and the lifetime gift and estate tax exemption is now 1206 million. Web That tax is usually paid by the donor the giver of the gift. Web The gift tax is a federal tax that applies when you transfer property to another person and dont receive the full value in return.

Web How the lifetime gift tax exclusion works. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. New Jersey abolished the estate.

For 2022 the annual gift exclusion is 16000.

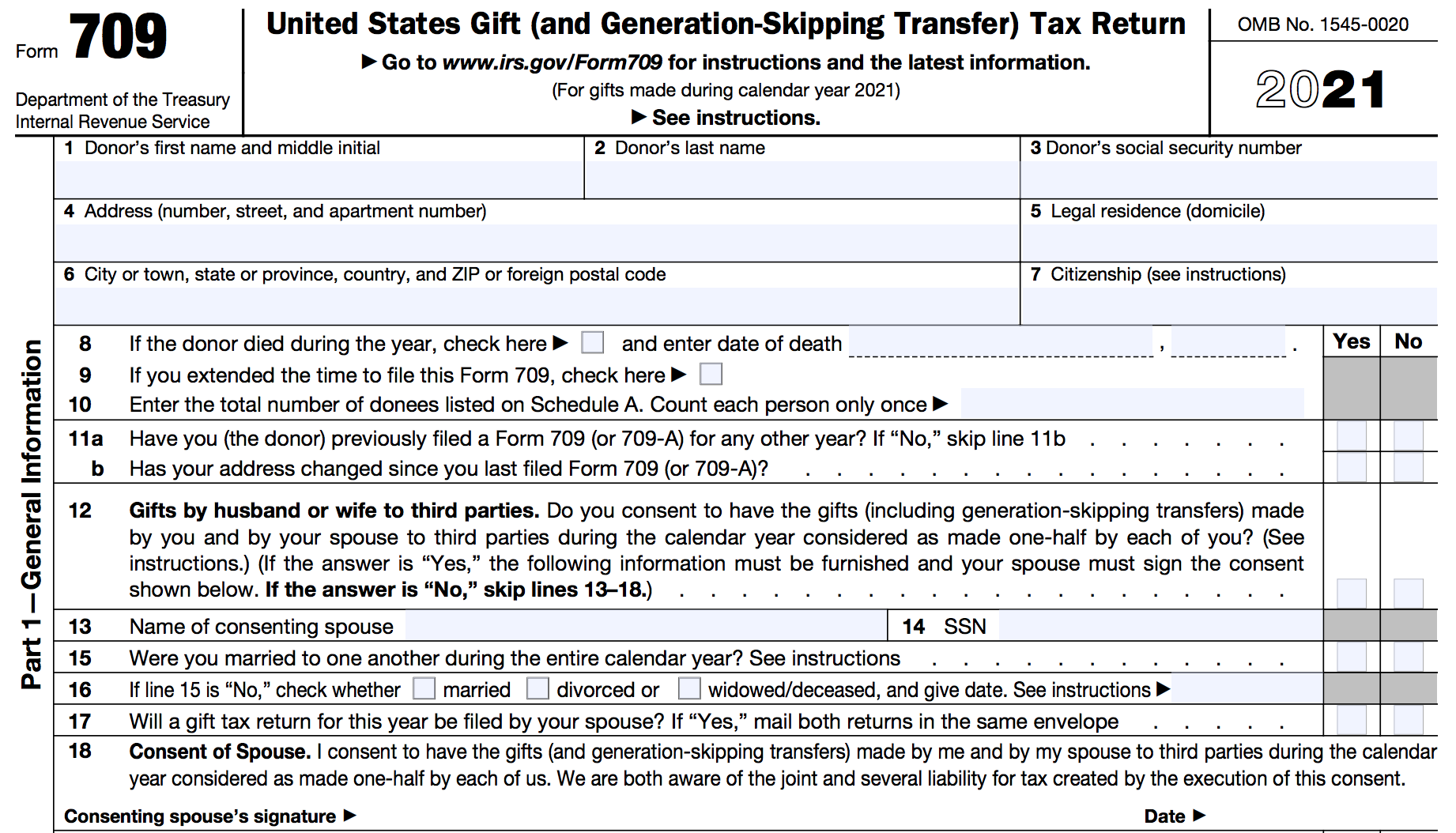

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

March 4 2021 Trusts Estates Group News Key 2021 Wealth Transfer Tax Numbers

What Is The 2022 Gift Tax Limit Ramsey

How Does The Gift Tax Work Personal Finance Club

Annual Gift Tax Exclusion Explained Pnc Insights

Private Wealth Legal Alert The Irs Is Expected To Adjust Certain 2023 Exclusions And Exemptions For Inflation Husch Blackwell

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 What It Is And Who Must File It

Gift Tax Limits For 2022 Annual And Lifetime Magnifymoney

Annual Gift Tax Exclusions First Republic Bank

What S New In 2022 Gift And Estate Tax Exemption Updates Cerity Partners

2022 State Tax Reform State Tax Relief Rebate Checks

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Gift Tax Exclusion For Tuition Frank Financial Aid

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra